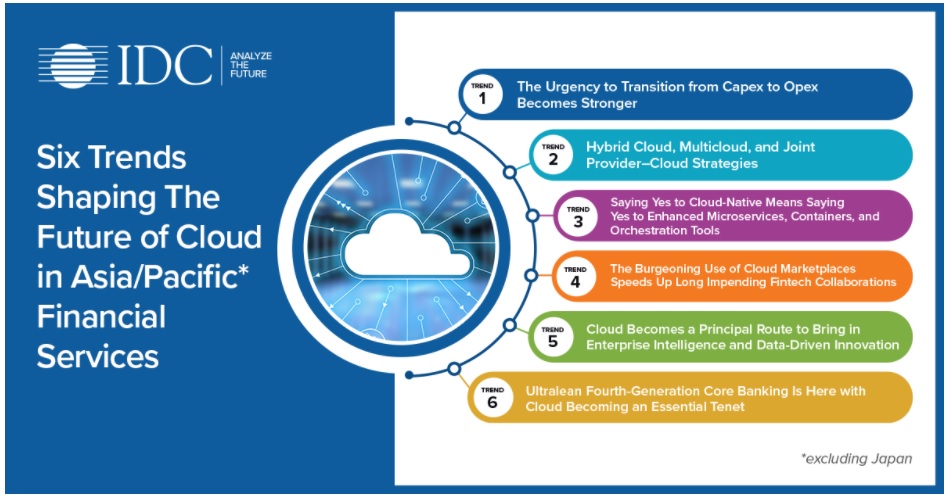

The COVID-19 pandemic has significantly accelerated the demand for digital transformation at the same time, technology investments are under more scrutiny to deliver more for less. This has urged organizations to pivot to cloud services to secure scalable, resilient, available, and agile IT operations to be most effective. IDC Financial Insights Asia/Pacific’s latest report Cloud Outlook 2021: Cloud Is Increasingly Becoming a Primary Route for Financial Services Collaboration, Innovation, and Transformation presents the way Asia/Pacific financial services institutions must manage their future strategies to cloud. The report underscores six market trends that continue to define cloud demand and the future of cloud in financial services in 2021 and beyond.

"Cloud will continue to be a significant foundational pillar for financial services institutions for the foreseeable future. As enterprises invest in cloud, IDC has observed that the ability to shift cloud spending from capex to opex has proven to be a successful enabler for future cloud investments, scalability, and availability,” says Sneha Kapoor, Research Manager at IDC Financial Insights Asia/Pacific.

According to IDC's Worldwide Public Cloud Services Spending Guide, January 2021, Asia/Pacific excluding Japan (APEJ) public cloud spend of financial services institutions (FSIs) will grow over three times from USD 4.9 billion in 2019 to USD 18.1 billion in 2024 at a compound annual growth rate (CAGR) of 29.9%. As cloud investment models continue to evolve, the way FSIs manage their cloud services must evolve as well. The next 24 months will usher in a continued shift from monolithic models to more simplified cloud services.

IDC Financial Insights expects that by 2023, 85% of tier-1 and tier-2 APEJ banks will curate an infrastructure strategy by coalescing on-premises/dedicated private clouds and multiple public clouds, along with legacy platforms, to assuage their many infrastructure requirements. “Hybrid cloud environments and the use of multi-clouds means a more agnostic experience for delivering container-based workloads. Expanding microservices will offer increased tangible benefits and leverage developer independence, scalability, and rapid deployment capabilities,” adds Clay Miller, Senior Executive Advisor at IDC Financial Insights Asia/Pacific.

In

In

Add new comment