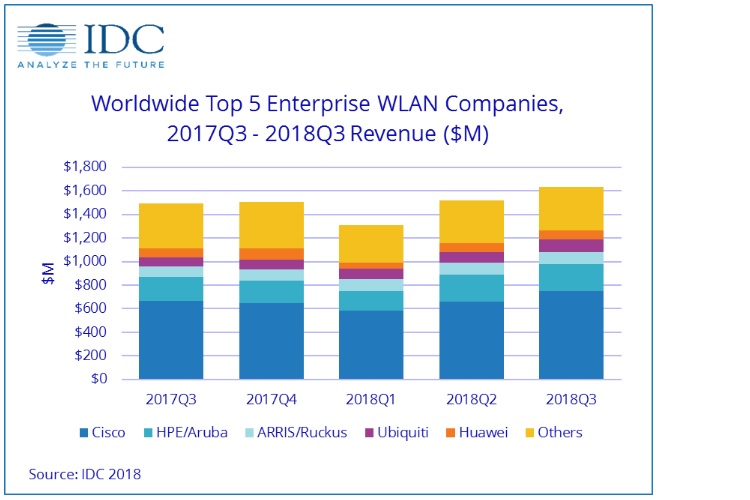

The combined enterprise and consumer wireless local area network (WLAN) market segments rose 6.9% year over year in the third quarter of 2018 (Q3, 2018) with worldwide revenues of USD 2.7 billion, according to IDC’s Worldwide Quarterly WLAN Tracker. The enterprise segment rose 9.8% year over year in Q3, 2018 to USD 1.6 billion. Sustained high demand for wireless access technologies combined with new advanced software management and automation capabilities continue to drive growth in this market.

The 802.11ac standard now accounts for 87.0% of dependent access point unit shipments in the enterprise segment and 94.6% of dependent access point revenues, marking this standard's full penetration into the market. Beginning early in 2019 the market will begin to shift toward adoption of the new 802.11ax standard, with operators of large public venues and other dense Wi-Fi environments being the earliest adopters.

Meanwhile, the consumer WLAN market rose 2.8% year over year to USD 1.1 billion. For the first time, 802.11ac shipments accounted for more than half of the market's volume, rising to 52.5% of units shipped and 75.5% of revenues. The previous-generation 802.11n standard accounted for 47.5% of shipments, but only 24.5% of revenues.

From a geographic perspective, the enterprise WLAN market in Q3, 2018 saw healthy growth in the Asia/Pacific (excluding Japan) (APeJ) region, which rose 5.4% year over year. Indonesia was a standout in the region, growing 56.3% year over year, while the region's largest market, the People’s Republic of China (PRC) was up 3.7%. Growth in the Philippines was up 26.7% year over year. Japan, meanwhile, grew 21.7%.

The Central and Eastern Europe region grew 20.3% year over year. Poland’s market was up 42.3% year over year, while Russia’s market grew 14.4%. The Western Europe region, meanwhile grew 7.9% year over year, and was up 6.3% sequentially. Standouts in the region included Ireland up 45.9% and France up 11.6%, which were offset by a 3.0% decline in the region’s largest economy in Germany. Middle East and Africa grew 18.1% year over year. The United Arab Emirates grew 23.3% while Israel’s market was up 36.0%.

The Latin America region was up 17.1% compared to a year earlier. Mexico’s growth stood out, rising 19.0% compared to a year earlier, while Colombia's market was up 38.9%. The North America market rose 10.0% year over year and was up 4.3% over the second quarter of 2018.

Key Enterprise WLAN Company Highlights

- Cisco’s worldwide enterprise WLAN revenue increased 12.8% year over year and it grew 13.8% quarter over quarter, marking a strong quarter for the company. That helped the company increase its market share to 46.0%, up from 44.7% in the same quarter of 2017.

- Aruba-HPE’s revenues increased 10.7% year over year but were down 1.1% sequentially, giving the company a 13.8% market share.

- ARRIS/Ruckus continued to perform well with growth of 19.9% year over year and 3.8% sequentially. The company’s market share grew from 5.9% in Q3, 2017 to 6.4% in the most recent quarter. During the fourth quarter of 2018 a preliminary deal for CommScope to purchase ARRIS, and in turn Ruckus, was announced, but it has not yet been finalized.

- Ubiquiti continued the company’s strong growth with revenues increasingly 32.4% year over year and 21.5% quarter over quarter. That helped propel the company’s market share to 6.4%, up from 5.3% a year earlier.

- Huawei showed some moderation with growth of 4.6% year over year but just 0.9% sequentially. The company's market share dropped from 5.0% in Q3, 2017 to 4.8% a year later.

In

In

Add new comment