Asia/Pacific excluding Japan (APeJ) spending on security related hardware, software and services will reach USD 28.76 billion in 2022 with a compound annual growth rate (CAGR) of 20.7% over the forecast period 2017-22, according to IDC Worldwide Semiannual Security Spending Guide. Security spending is estimated to reach USD 13.41 billion this year, an increase of 19.6% against 2017.

Security-related services will be both the largest (USD 5.3 billion in 2018) and the fastest growing (23.3% CAGR) category of APeJ security spending. Managed security services will be the largest segment within the services category, delivering almost 45 to 50% of the technology category total in 2022. Integration services and consulting services will be responsible for most of the remainder. Security Hardware is the second-largest category with spending expected to total USD 4.9 billion in 2018. Network security hardware will be the largest hardware segment throughout the forecast period, followed by data security hardware. Most of the spend in network security hardware is led by Unified Threat Management and Firewall technology hardware. Software spend will reach USD 3.1 billion in 2018 with a five-year CAGR of 14% only.

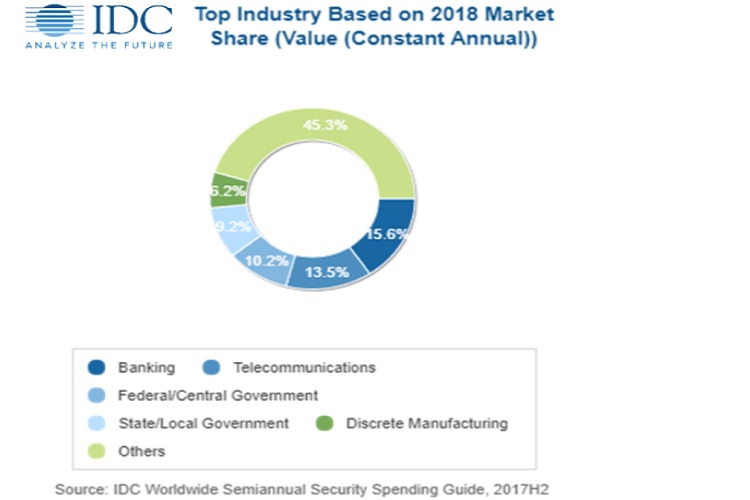

Banking will make the largest investment in security solutions, growing double-fold from USD 2.1 billion in 2018 to USD 4.5 billion in 2022. Security-related services, led by managed security services, will account for more than half of the industry's spend throughout the forecast. The second and third largest industries in year 2018, which are discrete manufacturing and federal/central government (USD 1.8 billion and USD 1.3 billion in 2018, respectively) are led by Hardware technology group. The industries that will see the fastest growth in security spending will be Resource Industry (24.2% CAGR), state/local government (24% CAGR), and Utilities (22.9% CAGR).

From a company size perspective, large and very large businesses (those with more than 500 employees) will be responsible for nearly two thirds of all security-related spending in 2018. Small businesses (10-99 employees) will see the strongest spending growth of 21.5%, which will be neck to neck growth with 21.4% in very large businesses (1000+ employees) and 21.3% in large businesses (500-999 employees) over the forecast period. Small offices (1-9 employees) and medium size businesses (100 to 499 employees) will also experience moderately good growth of 20.3% and 19.8% respectively.

From a geography perspective, IDC counts two sub regions under APeJ, which are China and Rest of Asia Pacific (excluding Japan & China). China will only account to 39.7% of total APeJ security solutions spend in 2018 but will gain traction by year 2022 by accounting to almost 50% of total APeJ market. China will show a record five-year CAGR of 26.6% as compared to 16.2% recorded by Rest of APeJ region. Telecommunications and State/Local Government are the two leading drivers of Chinese market for security related solutions, collectively accounting to 35% share from overall China spend in 2018. Industrial spend in APeJ (excluding China) will be led by strong demand in India, Singapore and Malaysia.

In

In

Comments

Wo Kann Man Revia Ohne Rezept

Wo Kann Man Revia Ohne Rezept Kaufen https://cheapcialisir.com/ - online cialis pharmacy Propecia Help Proscar <a href=https://cheapcialisir.com/#>cialis coupons</a> Viagra E Cialis Insieme

Add new comment