Global spending on cognitive and artificial intelligence (AI) systems will continue its trajectory of robust growth as businesses invest in projects that utilize cognitive/AI software capabilities. According to a new update to the International Data Corporation (IDC) Worldwide Semi-annual Cognitive Artificial Intelligence Systems Spending Guide, spending on cognitive and AI systems will reach USD 77.6 billion in 2022, more than three times the USD 24.0 billion forecast for 2018. The compound annual growth rate (CAGR) for the 2017-2022 forecast period will be 37.3%.

“The market for AI continues to grow at a rapid pace,” said David Schubmehl, research director, Cognitive/Artificial Intelligence Systems at IDC. “Vendors looking to take advantage of AI, deep learning and machine learning need to move quickly to gain a foothold in this emergent market. IDC is already seeing that organizations using these technologies to drive innovation are benefitting in terms of revenue, profit, and overall leadership in their respective industries and segments.”

Software will be both the largest and fastest growing technology category throughout the forecast, representing around 40% of all cognitive/AI spending with a five-year CAGR of 43.1%. Two areas of focus for these investments are conversational AI applications (e.g., personal assistants and chatbots) and deep learning and machine learning applications (employed in a wide range of use cases). Hardware (servers and storage) will be the second largest area of spending until late in the forecast, when it will be overtaken by spending on related IT and business services. Both categories will experience strong growth over the forecast (30.6% and 36.4% CAGRs, respectively) despite growing slower than the overall market.

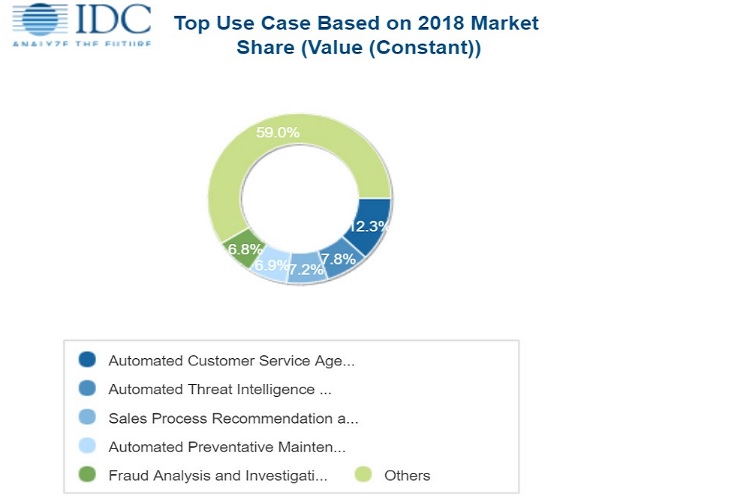

The cognitive/AI use cases that will see the largest spending totals in 2018 are automated customer service agents (USD 2.9 billion), automated threat intelligence and prevention systems (USD 1.9 billion), sales process recommendation and automation (USD 1.7 billion) and automated preventive maintenance (USD 1.7 billion). The use cases that will see the fastest investment growth over the 2017-2022 forecast are pharmaceutical research and discovery (46.8% CAGR), expert shopping advisors & product recommendations (46.5% CAGR), digital assistants for enterprise knowledge workers (45.1% CAGR), and intelligent processing automation (43.6% CAGR).

Source: IDC Worldwide Semi-annual Cognitive Artificial Intelligence Systems Spending Guide

“Worldwide Cognitive/Artificial Intelligence Systems spend has moved beyond the early adopters to mainstream industry-wide use case implementation,” said Marianne Daquila, research manager Customer Insights & Analysis at IDC. “Early adopters in banking, retail and manufacturing have successfully leveraged cognitive/AI systems as part of their digital transformation strategies. These strategies have helped companies personalize their relationship with customers, thwart fraudulent losses, and keep factories running. Increasingly, we are seeing more local governments keeping people safe with cognitive/AI systems. There is no doubt that the predicted double-digit year-over-year growth will be driven by even more decision makers, across all industries, who do not want to be left behind.”

Banking and retail will be the two industries making the largest investments in cognitive/AI systems in 2018 with each industry expected to spend more than USD 4.0 billion this year. Banking will devote more than half of its spending to automated threat intelligence and prevention systems and fraud analysis and investigation while retail will focus on automated customer service agents and expert shopping advisors & product recommendations. Beyond banking and retail, discrete manufacturing, healthcare providers, and process manufacturing will also make considerable investments in cognitive/AI systems this year. The industries that are expected to experience the fastest growth on cognitive/AI spending are personal and consumer services (44.5% CAGR) and federal/central government (43.5% CAGR). Retail will move into the top position by the end of the forecast with a five-year CAGR of 40.7%.

On a geographic basis, the United States will deliver more than 60% of all spending on cognitive/AI systems throughout the forecast, led by the retail and banking industries. Western Europe will be the second largest region, led by banking and retail. China will be the third largest region for cognitive/AI spending with several industries, including state/local government, vying for the top position. The strongest spending growth over the five-year forecast will be in Japan (62.4% CAGR) and Asia/Pacific (excluding Japan and China) (52.3% CAGR). China will also experience strong spending growth throughout the forecast (43.8% CAGR).

In

In

Add new comment