The COVID-19 crisis led most enterprises in APeJ region to prioritize digital infrastructure resiliency investments to ensure long-term business resiliency and success. Public cloud services are building blocks that enable this with flexibility and quick deployment, allowing agility in IT operations. According to IDC’s Worldwide Public Cloud Services Spending Guide, enterprises are now implementing a mechanism to shift to cloud-centric infrastructure and applications, leading to year-on-year expected growth of 28.8% in 2021 for public cloud services and estimated to reach USD124 billion by 2025 for the region.

"Focus is now shifting to post-pandemic growth to support new business operational requirements, rapid scalability, reduced risk, and enhanced customer experience. IT Infrastructure development and change in organization policy have further boosted growth in spend,” said Mario Allen Clement, Senior Market Analyst, IDC APEJ IT Spending Group.

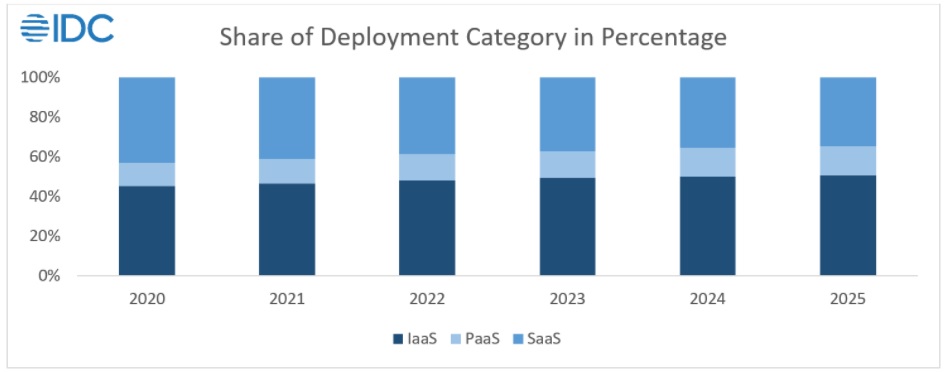

Cloud Infrastructure as a Service (IaaS) is expected to grow at 32.7% in 2021, making around 46% of the overall spending. IDC also expects IaaS spending to surpass the cloud software spending in the coming years as infrastructure development has been allocated in a phase-wise deployment over a period to accommodate growing expansion and upgrade. Software as a Service (SaaS) is the second largest with a 41% share in terms of spending. Platform as a service (PaaS) follows with a 12% share.

"Cloud and cloud-centric operating models have become integral components of the modern IT environment. The pandemic has put cloud to the test in terms of delivering on the promises of agility, flexibility, and scalability, and organizations are recognizing it as critical to their IT strategy moving forward as they embrace digital infrastructure resilience to underpin their DX journey,” said Daphne Chung, Research Director, IDC APEJ Cloud Services and Software.

Source: IDC Worldwide Public Cloud Services Spending Guide (June - V2)

According to the IDC’s 2021 Future Enterprise Resilience and Spending Survey (Wave 5), more than 50% of the enterprise across multiple industries responded that they are looking at remote processes to continue business operations. Remote processes ensure that there is a reduced dependency on government regulations to curb recurring waves of infections. Respondents in the same survey from countries like Australia, India, Indonesia, and Malaysia indicated that more than 50% of organizations focus on cloud infrastructure investments to enable remote operations.

Professional Services continue to be the highest contributing industry within the market, with a growth of over 35% in 2021. As demand has shot up for these services across all countries within the region, most organizations upgraded their operations. Banking follows in a close second in terms of market share with expected growth of 27% in 2021. Banks cater to a vast customer base, which has now seen a massive change in its day-to-day activities over the last year. This has pushed many banks to upgrade their infrastructure to innovate their current offerings across the region. Banks have now allowed employees to access customer information working from home in many customer service requirements, which requires a highly secure cloud functionality to enable information passing through the bank's database.

In

In

Add new comment