The overall server market in India witnessed a year-over-year (YoY) growth of 0.3% in terms of revenue to reach USD281.1 million in Q3 2020 (Jul-Sep) versus USD280.1 million in Q3 2019, according to IDC’s Worldwide Quarterly Server Tracker, Q3 2020 (December 2020 release). The x86 server market contribution had grown to 91.2% in terms of revenue, a growth of 5.9 percentage points over last year’s same quarter. This contribution to the x86 market mainly came from professional services, telecommunications, and banking verticals. In the professional services vertical, global hyperscaler spend was directed towards building infrastructure to support business continuity operations of end customers whereas telecommunication spend was seen towards building and modernizing their network. Banks continue to spend on compute, supporting the upsurge of digital transactions and on-going digitalization projects.

The x86 server market in terms of revenue grew YoY by 7.3% to reach USD256.4 million in Q3 2020 up from USD239.0 million in Q3 2019. The growth largely came from the custom-built server category with revenue growth of 18.3% YoY. Hyperscalers were seen spending on infra to build capacity and expanding their data center footprint across various availability zones. The general-purpose server witnessed revenue growth of 4.5% due to the spending coming from very large customers across different industries. On the other hand, small and medium businesses, and large businesses failed to show signs of recovery caused due to the pandemic. During Q3 2020, verticals such as insurance, securities and investment services, and process manufacturing witnessed the highest YoY growth in terms of revenue at 201.5%, 137.5%, and 107.4% respectively.

The non-x86 server market declined YoY by 40.1% to reach USD24.7 million revenue in Q3 2020. IBM continues to dominate the market accounting for 74.4% of revenue share during Q3 2020 with a revenue of USD18.4 million. Oracle came at second position followed by Hewlett Packard Enterprise (HPE) with a revenue share of 20.8% and 4.8% respectively.

Vendor Highlights – x86 Server Market:

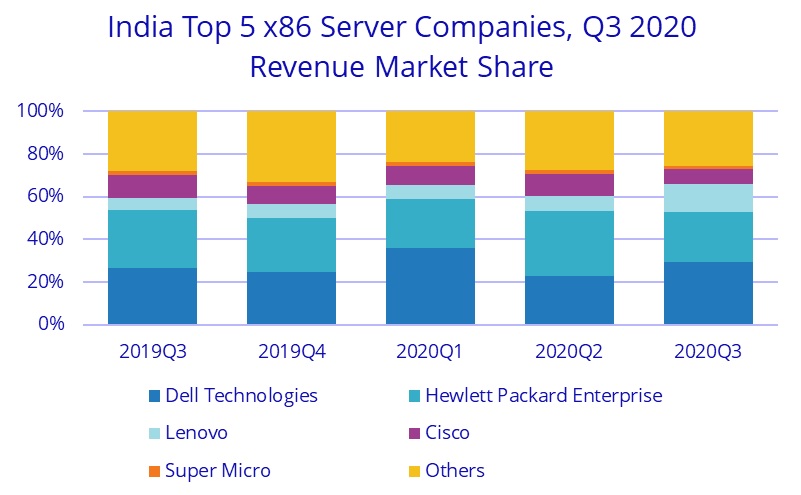

Source: IDC Worldwide Quarterly Server Tracker, Q3 2020 (December 2020 release)

In Q3 2020, Dell Technologies emerged as the top vendor in the India x86 server market with a revenue share of 29.3% and revenue of USD75.1 million. The top three verticals for Dell Technologies were professional services, telecommunications, and banking.

HPE was ranked at second spot with a revenue share of 23.5% and revenue of USD60.3 million. Key verticals for HPE were process manufacturing, telecommunications, and professional services.

At number three is Lenovo with a revenue share of 13.0% and revenue of USD33.4 million. Cisco came in fourth accounting for a revenue share of 7.0% and revenue of USD18.0 million.

“During Q3 2020, the server market showed signs of recovery after H1 2020 was badly hit by the pandemic. For Q4 2020, we expect the biggest contribution to come from very large enterprise customers and hyperscalers. Vertical such as telecommunications, banking, and professional services are expected to account for a higher pie of the overall server market in Q4 2020,” says Harshal Udatewar, Market Analyst, Server, IDC India.

IDC India Forecast

India’s economy in the third and fourth quarter of the ongoing fiscal year is likely to be positive. From an Enterprise spending perspective, we anticipate investments in compute to come from banks, digital wallets firms, and payment gateway companies to support ever-increasing digital transactions. Telecommunications spending would be focused on network modernization, VAS services, and preparing for the 5G roll out. At present, the India x86 server market is expected to witness a YoY decline in value by 14.1%, during the period of 2019-2020, according to latest IDC Worldwide Quarterly Server Forecast, Q3 2020 (December 2020 Release).

In

In

Add new comment