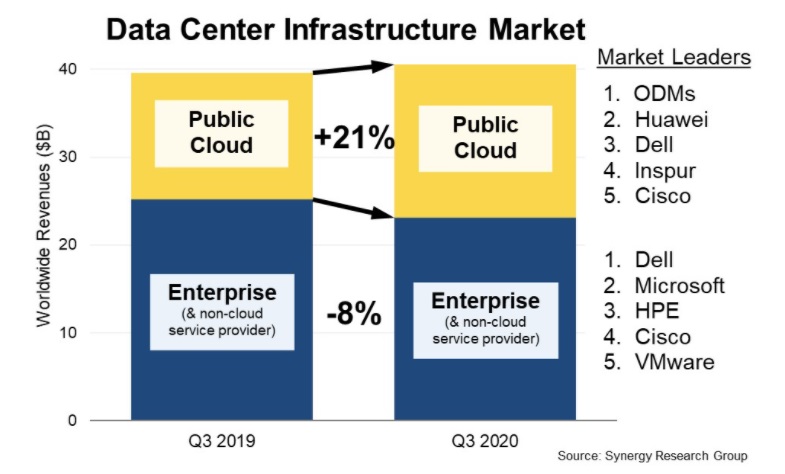

Worldwide spend on data center hardware and software nudged upwards by 2% from the third quarter of 2019, thanks entirely to a 21% jump in spending on public cloud infrastructure, which pushed it to an all-time high, according to new Q3 data from Synergy Research Group. Cloud providers continue to invest heavily in their data centers to satisfy the ever-increasing demand for their services. Meanwhile enterprise spending on their own data center infrastructure dropped 8% from last year, the third consecutive quarter to feature a substantial decline. In terms of market share, ODMs in aggregate account for the largest portion of the public cloud market, with Huawei, Dell and Inspur jostling for position to be the leading individual vendor. The Q3 market leaders in enterprise infrastructure were Dell and Microsoft, followed at a distance by HPE, Cisco and VMware.

Total data center infrastructure equipment revenues, including both cloud and non-cloud hardware and software, were USD 40.5 billion in Q3, with public cloud infrastructure accounting for 43% of the total. The main hardware-oriented segments of servers, storage and networking in aggregate accounted for 76% of the data center infrastructure market. OS, virtualization software, cloud management and network security account for the balance. By segment, Dell is the leader in server and storage revenues, while Cisco is dominant in the networking segment. Microsoft features heavily in the rankings due to its position in server OS and virtualization applications. Outside of these three, the other leading vendors in the market are HPE, Huawei, Inspur, VMware, Lenovo and IBM.

“The total data center equipment market is in a reasonably steady state, with growth over the last six quarters averaging 2%, but the mix of spending by public cloud providers and enterprises continues to shift substantially in favor of cloud,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The cloud provider share of the total has increased by around two percentage points in each of the last three quarters, which represents a fairly dramatic change in such a massive market. The shift towards cloud was happening prior to that, but at a much more gradual pace. It almost goes without saying that COVID-19 has been a catalyst behind that change in trajectory.”

In

In

Add new comment