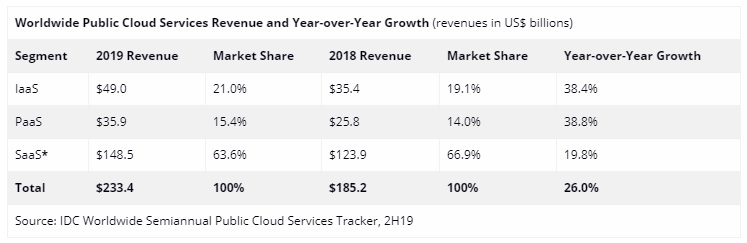

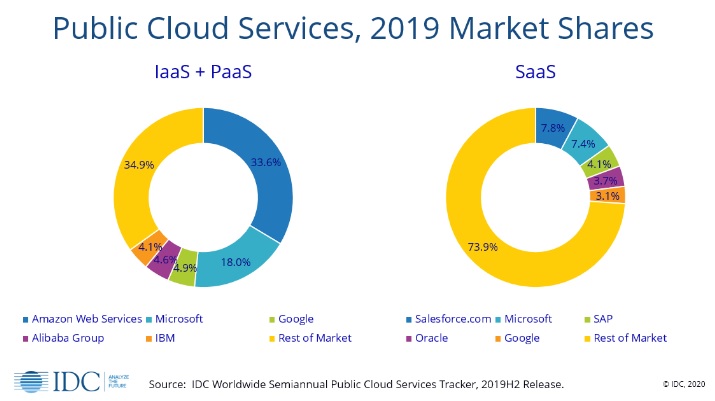

The worldwide public cloud services market, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), grew 26.0% year over year in 2019 with revenues totaling USD 233.4 billion, according to the IDC Worldwide Semiannual Public Cloud Services Tracker. Spending continued to consolidate in 2019 with the combined revenue of the top 5 public cloud service providers (Amazon Web Services, Microsoft, Salesforce.com, Google, and Oracle) capturing more than one third of the worldwide total and growing 35% year over year.

“Cloud is expanding far beyond niche e-commerce and online ad-sponsored searches. It underpins all the digital activities that individuals and enterprises depend upon as we navigate and move beyond the pandemic,” said Rick Villars, group vice president, Worldwide Research at IDC. “Enterprises talked about cloud journeys of up to ten years. Now they are looking to complete the shift in less than half that time.”

The public cloud services market has more than doubled since 2016. During this same period, the combined spending on IaaS and PaaS has nearly tripled. This highlights the increasing reliance on cloud infrastructure and platforms for application deployment for enterprise IT internal applications as well as SaaS and digital application delivery. IDC expects spending on IaaS and PaaS to continue growing at a higher rate than the overall cloud market over the next several years as resilience, flexibility, and agility guide IT platform decisions.

“Today's economic uncertainty draws fresh attention to the core benefits of IaaS – low financial commitment, flexibility to support business agility, and operational resilience,” said Deepak Mohan, research director, Cloud Infrastructure Services. “Cost optimization and business resilience have emerged as top drivers of IT investment decisions and IaaS offerings are designed to enable both. The COVID-19 disruption has accelerated cloud adoption with both traditional enterprise IT organizations and digital service providers increasing use of IaaS for their technology platforms.”

“Digitizing processes is being prioritized by enterprises in every industry segment and that is accelerating the demand for new applications as well as repurposing existing applications,” said Larry Carvalho, research director, Platform as a Service. “Modern application platforms powered by containers and the serverless approach are providing the necessary tools for developers in meeting these needs. The growth in PaaS revenue reflects the need by enterprises for tools to accelerate and automate the development lifecycle.”

“SaaS applications remain the largest segment of public cloud spending with revenues of more than USD 122 billion in 2019. Although growth has slowed somewhat in recent years, the current crisis serves as an accelerator for SaaS adoption across primary and functional markets to address the exponential growth of remote workers,” said Frank Della Rosa, research director, SaaS and Cloud Software.

* Note: SaaS revenues include both SaaS Applications and SaaS System Infrastructure Software.

Looking at the segment results, a combined view of IaaS and PaaS spending is relevant because it represents how end customers consume these services when deploying applications on public cloud. IDC has been tracking and publishing this view of the market since 2019. In the combined IaaS and PaaS market, Amazon Web Services and Microsoft captured more than half of global revenues. But there continues to be a healthy long tail, representing over a third of the market. These are typically companies with targeted use case-specific PaaS offerings. The long tail is even more pronounced in SaaS, where nearly three quarters of the spending is captured outside the top 5.

In

In

Add new comment