The overall server market in India witnessed a year-over-year (YoY) decline of 22.1% in terms of revenue to reach USD 232.1 million in Q1, 2020 (Jan-Mar) versus USD 298.0 million in Q1, 2019, according to IDC’s Worldwide Quarterly Server Tracker, Q1, 2020 (June 2020 release). The x86 server market accounts for 85.2% of the overall server market in terms of revenue.

Major contribution to the x86 server market continues to come from the professional services and telecommunications segments, followed by banking and manufacturing verticals. Large deals were witnessed from telecommunication vendors, nationalized banks, digital wallets companies, global high-tech semiconductor manufacturing companies, and various federal government departments during Q1, 2020.

The x86 server market in terms of revenue declined YoY by 25.3% to reach USD 197.9 million in Q1, 2020 from USD 264.9 million in Q1, 2019. The decline was due to the lack of spending from global hyperscalers and spillover of deals into the next quarter. The restriction on the movement of goods amidst the pandemic resulted in delivery constraints with customers waiting to materialize their previous orders before placing newer ones. The market is expected to decline further inQ2, 2020 due to COVID-19 affecting the financial and operational balance of the industries. Recovery is expected to be observed in H2, 2020, owing to spend coming from federal government agencies, bank refresh, and network modernization projects from telecommunication vendors.

The non-x86 server market grew YoY by 3.6% to reach USD 34.2 million revenue, in Q1, 2020. IBM continues to dominate the market accounting for 74.1% of revenue share, during Q1, 2020 with a revenue of USD 25.4 million. Adoption of IBM’s server offerings is growing primarily across banks for their core banking and internet banking workloads. As a result, 79.4% of its revenue was seen coming from banks, followed by manufacturing. Oracle came at second position followed by Hewlett Packard Enterprise (HPE) with a revenue share of 14.6% and 11.3% respectively.

Vendor Highlights:

Source: IDC Worldwide Quarterly Server Tracker, Q1, 2020 (June 2020 release)

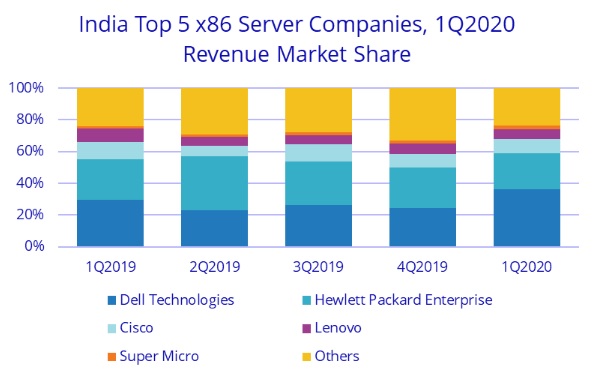

In Q1, 2020, Dell Technologies emerged as the top vendor in the India x86 server market with a revenue share of 36.0% and a revenue of USD 71.3 million. Key wins for Dell Technologies came from professional services, banks, high-tech semiconductor manufacturing companies, and telecommunication vendors. Hewlett Packard Enterprise (HPE) came at second spot with a revenue share of 23.1% and a revenue of USD 45.7 million. HPE picked up large orders from telecommunication vendors, professional services vertical, manufacturing, and federal government departments. At number three is Cisco with a revenue share of 8.8% and a revenue of USD 17.4 million. Lenovo came in fourth accounting for a revenue share of 6.3% and a revenue of USD 12.4 million.

“The market sentiment is pessimistic, and we anticipate a sharp decline for the server market revenue in Q2, 2020. As the lockdown continues to negatively impact working capital across businesses, buyers are now employing capital preservation strategies for future usage resulting in low spending on current IT requirements. In such a scenario, IDC expects the server market in 2020 to decline by 22.3% in terms of value,” says Harshal Udatewar, Market Analyst, Server, IDC India.

IDC India Forecast

COVID-19 continues to deteriorate the health of Indian economy and its outlook. The lockdown extension is imposing severe challenges across multiple sectors such as manufacturing, IT and ITeS, personal and consumer services, media, and others, due to which server market growth in 2020 seems highly uncertain. Enterprise spending is limited to essentials only, and projects with long completion time frame are either coming to a halt or getting deferred to a later time. However, we anticipate investments to emerge from federal bank departments for some greenfield projects, technical refreshes in H2, 2020 by banks and on-going projects from telecommunication vendors. Spending from two of the largest telecommunication vendors in the country would be primarily focused on network modernization, VoLTE, and cloud infra projects, while banks would be towards refreshes. At present, India x86 server market is expected to witness a YoY decline in value by 41.3%, during the period Q2, 2019-Q2, 2020, according to the latest IDC Worldwide Quarterly Server Forecast, Q1, 2020, (June 2020 Release).

In

In

Add new comment