Consumers across the globe are embracing digital payments more than ever during the COVID-19 pandemic. Against this backdrop, payment industry in the Asia-Pacific (APAC) region remains attractive for venture financing (VF), according to GlobalData’s study, titled Smart Money Investing in the Financial Services Industry Q1 2020.

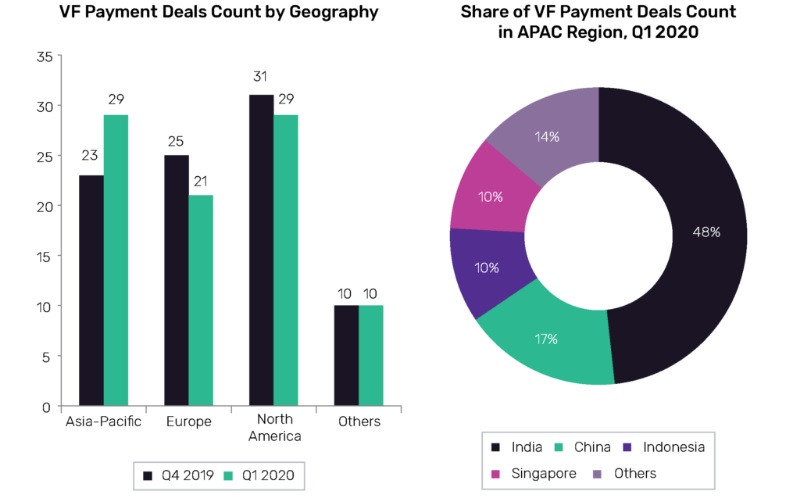

The study reveals that although there was decline in VF deals from 389 in Q4 2019 to 361 in Q1 2020, payment deals remained unchanged at 89 deals. This was due to increase in deals activities in the APAC region, with deal count increasing from 23 in Q4 2019 to 29 in Q1 2020.

Ravi Sharma, Banking and Payments Lead Analyst for GlobalData, explains: “With rapid digitalization, electronic payments tools are gaining prominence. This trend is more prevalent in emerging markets such as India and China, where large number of consumers leapfrogged card payments by switching directly from cash to alternative payment methods.”

Capitalizing on this, venture capitalists are increasingly making investments in the payment firms. India attracted 48.3% of the VF payment deals in Q1 2020 in the APAC region, followed by China (17.2%).

Figure: VF Payment Deals: Geographical Breakdown

Source: GlobalData Banking and Payments Intelligence Center

Traditional payment companies are also exploring new avenues in these countries to stay ahead in the market. For example, Mastercard invested in Digiasia Bios, an Indonesian financial technology company that offers digital payment and peer-to-peer (P2P) lending services, in March 2020.

Sharma concludes: “The pandemic has accelerated shift towards cashless economy, increasing the demand for digital payments among consumers and businesses alike. As a result, payments industry in APAC will continue to attract investments over the coming years.”

In

In

Add new comment