57.1% of utility companies in the Asia/Pacific* region say that their biggest triggers for cloud adoption are agility and speed, according to IDC’s Cloud Priorities within Asia/Pacific Utilities report. IDC believes that the ability to manage their IT environments and their data is a critical element of the digital transformation of Asia/Pacific utilities. Greater visibility and transparency are critical for utilities business, and companies are deploying workloads to the cloud in line with their business priorities. IDC predicts accelerated demand for cloud services by utility companies in the region will be driven by requirement for agility, speed, datacenter upgrade, application upgrade, modernization, and re-platforming.

Cloud strategy priorities are changing amongst Asia/Pacific* utilities. To date, cloud investments are more focused on private cloud – more than 75% of companies are currently leveraging private cloud services – primarily driven by security perceptions. Over the next couple of years this trend is expected to change as twice as many organizations have plans in place to implement public cloud.

Moreover, spending intentions show that public cloud is gaining attention for future investments – with 30% of organizations having firm plans to invest in public cloud within 24 months to gain quicker access to new functionalities. IDC’s forecast shows that public cloud services spending by utility companies within Asia/Pacific (excluding Japan and China) are expected to reach USD 650 million by 2023, growing at a compound annual growth rate (CAGR) of 19.7%. SaaS emerges as the biggest contributor in terms of absolute numbers, and PaaS rises at 26.7% CAGR – the largest of them all.

Jayesh Verma, Research Manager at IDC Energy Insights Asia/Pacific, suggests Utility companies in Asia/Pacific are on their journey to leverage cloud in order to meet the changing market needs and improve operational efficiency. “Utility companies are grappling with changing market dynamics and preparing themselves for the next stage of their digital transformation (DX) journey. Cloud is a fundamental DX enabler and will play a key role in enabling utility companies to bring down costs and improve operational efficiency,” says Verma.

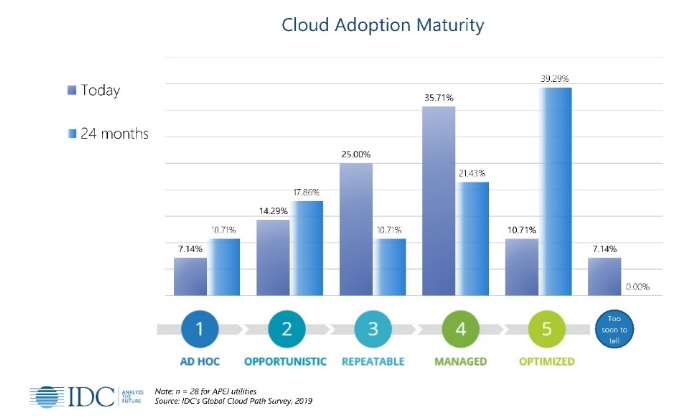

Cloud adoption will bring equal challenges while unfolding new opportunities. Companies need to be ready to adopt the needed change management involved in cloud adoption and usage. As Asia/Pacific* utility companies move their workloads to cloud based capabilities, creating an additional layer of IT infrastructure will be one of its challenges. Currently, only 10% of Asia/Pacific utility companies have an optimized cloud adoption strategy in place. To ensure reliability, availability, and responsiveness, proper roadmap and cloud adoption strategy should be in place.

IDC defines cloud adoption maturity in five stages, aimed to help IT and line-of-business (LOB) decision makers understand where their organizations are positioned with respect to their peers.

1. Ad hoc — Focused primarily on pilot projects and validation activities driven by the needs of individual decision makers and teams

2. Opportunistic — Driven by the business needs of individual workgroups and departments with no effort to share resources or create scalable, repeatable implementations

3. Repeatable — Consistent effort made to leverage and reuse best practices and resources throughout multiple groups and departments

4. Managed — Widespread use of cloud is supported by proactive business and IT leadership driving decisions about cloud use, operational policies, IT architectures, and contract negotiation and monitoring

5. Optimized — Have broadly implemented a cloud-native strategy proactively managed and is clearly driving business results and innovation while also improving IT operational efficiency

Figure: Cloud Adoption Maturity

Cloud computing is providing new ways to utility companies of approaching technology and its infrastructure, and more than a third of respondents within Asia/Pacific* utilities believe that cloud has provided consistent and predictable opportunities for innovation. However, IT governance and security concerns related to trust, data privacy and breaches, and system vulnerability are major challenges limiting cloud deployment.

In

In

Add new comment