The overall server market in India witnessed a year-over-year (YoY) decline of 8.1% in terms of revenue to reach USD 276.6 million in Q3, 2018 versus USD 300.9 million in Q3, 2017, according to the latest IDC Asia Pacific excluding Japan (APEJ) Quarterly Server Tracker, Q3 2018. The x86 server market has degrown for Q3, 2018 which accounted for 91.6% of overall server market in terms of revenue. The decline is majorly due to the absence of multi-million dollar deals from IT and ITeS service providers and spillover of telco deals in the coming quarters.

Modernization of traditional infrastructure remains as the core priority for the enterprises across different verticals in India. Almost more than 90% of the enterprises are planning to invest in digital initiatives from creating new business models, to reimagining their existing business through process reengineering to attract and retain their existing customers and enhancing their customer experiences creating a demand for the compute to meet these business objectives.

During Q3, 2018, the x86 server market in terms of revenue declined YoY by 6.1% to reach USD 253.4 million in Q3, 2018 up from USD 269.9 million during Q3, 2017. Professional services accounted for 57.5% of overall x86 server market revenue contribution followed by telecommunications with 10.4% during Q3, 2018. Manufacturing and Banking were slow during Q3, 2018 owing to limited new deals and small upgrades. In x86 market, volume servers declined by 7.2% to USD 240.2 million, while midrange server increased by 24.6% to reach USD 13.2 million in Q3, 2018. Non-intel platforms are still preferred for the high-end category of servers by most of the large end-users.

The non x86 server market generated USD 23.2 million revenue, with a YoY decline of 24.9 percentage points, in Q3, 2018. IBM led the market with a revenue share of 63.8%, followed by Oracle with share of 22.5 and HPE with 13.8% during Q3, 2018. Banking remains top vertical with 51.8% revenue share followed by manufacturing and professional services with 22.5%, and 8.9% respectively, during Q3, 2018.

“End users in India are slowly adopting hybrid IT for their datacenter strategy. Thus, it has become crucial for vendors to market their solutions by addressing end-users challenges such as compatibility, migration, application performance and IT support serviceability features” says Ranganath Sadasiva , Director, Enterprise Research, IDC India.

Vendor Highlights

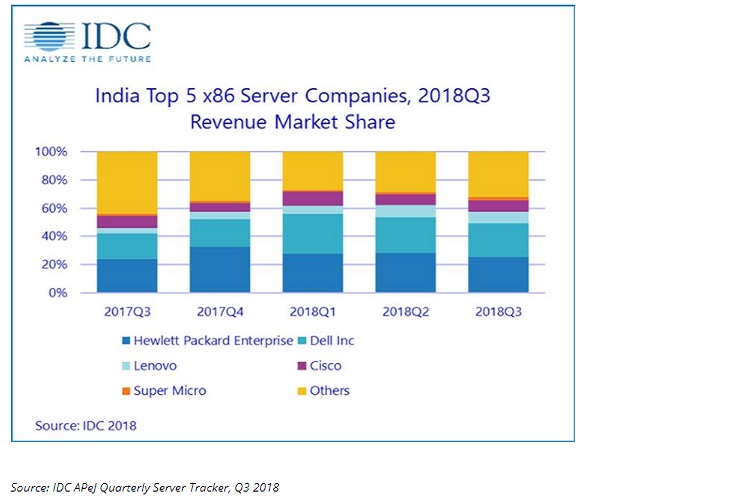

In Q3, 2018, Hewlett Packard Enterprise (HPE) achieved the number one position in the India x86 server market with revenue share of 25.5% to reach USD 64.6 million in Q3, 2018. Dell was the second largest vendor with share of 23.6% to reach USD 59.8 million. Lenovo and Cisco remain statistically tied at number third position with a revenue share of 8.4% and 8.2% respectively. Also, ODM direct market share declined YoY by 33.8% and accounted for 27.4% revenue share in Q3, 2018.

“In 2018, end users have embraced memory centric computing with higher cores and CPU configurations resulting into Y/Y growth of server ASP. The industries journey continues to evolve from large SMP machines to scale out in the coming years,” says Harshal Udatewar, Market Analyst, Server, IDC India.

IDC India Forecast

Government remains to be the major driver of growth for the server market with ongoing smart city projects, NSM, HPC and other Government led initiatives expected to fuel the growth of server market in the coming quarters. However, the general election in 2019 will be affecting the growth of server market because of lesser Government spend.

Tier-1 telcos spend would be directed towards expanding VoLTE across different circles, modernizing infra for the 5G roll outs and virtualizing the RAN for better control and network performance. We are expecting telco investments to continue throughout 2019 and 2020. Refresh from some of the banks are expected in 2019 while manufacturing spend would be focussed towards ERP upgrades and automation in SCM and operational processes creating a demand for compute throughout 2019.

In

In

Add new comment